Cell Phone Tower Lease Rates

Cell Tower Lease Rates

One of the most common questions we receive from clients is, “What is the maximum rent I can earn from my property?” This question is much like asking, “What determines the value of my home?” A home’s price is influenced by factors such as size, quality, location, age, style, condition, and comparable sales. Similarly, several factors affect cell tower lease rates. However, the valuation of a cell tower lease is even more complex, as it must account for a range of elements tied to the wireless carrier’s overall network needs and infrastructure.

Why Are Cell Sites Needed?

Based on network requirements, carriers design new sites and task their real estate departments with securing locations that meet specific criteria. In many cases, the identified site candidates are sufficient to initiate the leasing process. The leasing team conducts due diligence by reviewing title reports to determine property ownership and assess the potential challenges of working with various owners—whether it be a large corporation like IBM, a government agency like the Bureau of Land Management, or a private individual such as Farmer John Smith. Leasing specialists carefully examine title documents, initiate contact with property owners, and coordinate site visits with other team members to evaluate which properties best meet the network design needs. This site selection process is critical to the success of the project.

What Influences Cell Tower Lease Rates

Whether negotiating a lease renewal for an existing cell site or establishing a new “greenfield” site, the rental rate is typically the primary concern for our wireless landlord clients. To help landlords better understand how monthly cell tower rents are determined, we have outlined the key factors that influence wireless lease rates:

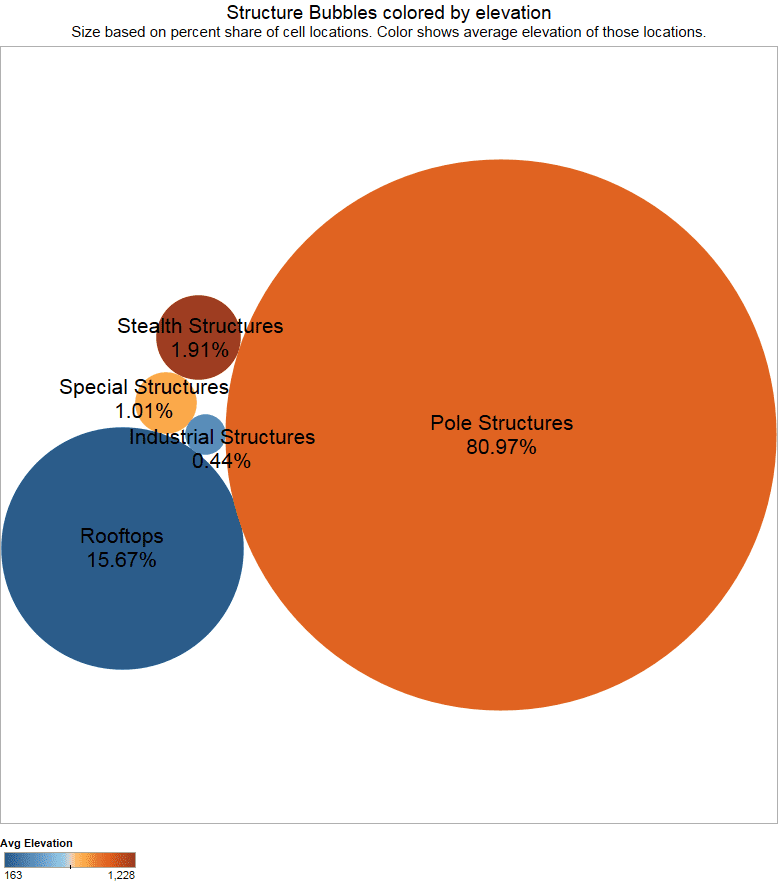

Rooftop Cell Sites on Commercial Buildings

Are cell tower antennas installed on the rooftop of your commercial building? If so, this is known as a “rooftop” cell site—one of the most desirable arrangements for a cell tower lease. Another common installation type is a “raw land site” (discussed below). While technically a rooftop site does not involve a traditional tower structure, landlords often use the term “cell tower” to describe both rooftop and raw land installations.

Rooftop sites typically command higher rental rates than raw land sites. This is largely because wireless carriers avoid the significant costs associated with constructing and maintaining a tower, including expenses related to tower maintenance, insurance, tower climbing (a high-risk, costly activity), FAA lighting requirements, and other liabilities.

Moreover, rooftop sites are generally concentrated in metropolitan areas, where numerous tall buildings are available but obtaining zoning approvals for new towers is particularly challenging. As a result, rooftop installations often present the only viable option for carriers in urban settings.

However, rooftop installations come with their own engineering complexities, such as structural analyses to ensure the building can support the heavy equipment (which may weigh thousands of pounds concentrated in small areas), drilling through rooftops, and extensive waterproofing requirements. These challenges are typically not encountered with raw land tower construction. Given these additional demands and the impact on the building’s structure, property owners are often able to negotiate higher rental rates for rooftop leases compared to traditional tower leases.

Cell Towers on Raw Land Sites

The most common type of cell site installation involves constructing a steel structure on land leased from property owners. Typically, the leased area ranges from 20’x20’ to 40’x40’, providing space for the tower, electronic equipment cabinets, power and telecommunications infrastructure, all enclosed within a secured, fenced perimeter accessible only to authorized carrier personnel.

At raw land sites, wireless carriers must build a steel tower tall enough to meet the antenna height requirements specified by their engineers. Common tower types include monopoles, lattice towers, guyed towers, flagpoles, and stealth structures—towers designed to blend into the environment by resembling trees, cacti, boulders, church steeples, and other natural or architectural features.

Lease rates for raw land tower sites are generally lower than those for rooftop installations. This is primarily because (1) raw land sites are often located on the outskirts of towns, where population and traffic density are lower, and (2) developing and constructing a tower on raw land typically involves higher costs than installing equipment on an existing rooftop. While exceptions to these general trends exist, they serve as reliable “rules of thumb” when evaluating lease opportunities.

Population Density and Cell Site Value

Cell sites located near densely populated areas typically allow landlords to command higher lease rental rates compared to those in more remote regions. Proximity to major metropolitan areas significantly increases a site’s value to wireless carriers, resulting in higher lease rates. For instance, rooftop leases in downtown Manhattan, New York, can demand substantially higher rents than similar sites in downtown Boise, Idaho.

At its core, a cell site in a heavily populated area can handle more voice and data traffic and is generally more cost-effective to maintain than one in a rural setting. These operational advantages make carriers willing to pay premium lease rates for urban locations. Additionally, since real estate costs are naturally higher in metropolitan centers than in rural areas, it follows that cell tower lease rates in major cities are also considerably higher.

Location Considerations

High-traffic locations such as shopping malls, stadiums, airports, and convention centers often host large crowds within a confined area. These gatherings generate enormous volumes of mobile data usage—through video uploads, emails, messaging, photo sharing, and more—quickly overwhelming standard cell tower capacity. As a result, wireless carriers must deploy specialized overlay systems capable of supporting the intense data and voice traffic demands at these venues. Property owners located near these high-demand venues often command higher lease rates for cell sites.

To accommodate the heavy concentration of users, carriers install in-building antenna systems that provide wireless coverage within the structures themselves, ensuring reliable service inside massive concrete and steel facilities. For example, a stadium holding 60,000 people requires cell infrastructure not only to support connectivity inside the venue but also outside, as attendees travel by bus, car, and foot to and from the event.

While in-building systems are typically negotiated directly with facility owners—such as professional sports leagues (NBA, NFL) or city convention authorities—wireless carriers must also secure external sites. These are typically installed on nearby monopoles or surrounding building rooftops to support the additional coverage demands.

But there must be an equally significant system external to these venues to support the same number of people entering and leaving these venues. A 60,000 person venue must have cell traffic capacity for 60,000 people inside the stadium, and 60,000 people outside the stadium as the same people bus, drive, park, and walk to and from the facilities. In-building systems are often negotiated with facility owners (NBA, NFL, City Convention Center Agencies, etc.)

Landlords who own properties near major venues generally hold strong negotiating leverage when dealing with wireless carriers. However, to manage costs, carriers often have multiple location options and must balance finding ideal coverage points with controlling rental expenses. Thus, while proximity to a major venue increases a property’s value, lease rates are still influenced by competition among available sites.

Popular Locations

Popular sites such as corporate campuses, national parks, university campuses, oceanfront beaches, nationally recognized racetracks, and marathon routes attract significant attention from wireless carriers. While these locations may not require the same intensive network infrastructure as malls or stadiums, they are frequented more consistently throughout the year, making reliable coverage critical. Wireless carriers and tower companies are highly motivated to offer strong service at these venues.

Securing lease space within these locations, however, can be extremely challenging. Many of these properties prioritize security, aesthetics, and environmental preservation over the added revenue from a cell tower lease, making negotiations difficult despite the potential financial benefits.

Highways, Freeways, and Metro Areas

An important priority for wireless carriers is ensuring strong coverage for the growing number of people spending increased time in their vehicles. To achieve this, carriers strategically position cell sites along highways and freeways with the highest daily traffic counts. Traffic congestion also influences site selection, as areas prone to traffic jams experience spikes in phone calls and data usage.

Cell sites located adjacent to major transportation routes often command higher lease rates due to their strategic importance. However, proximity to a busy road alone does not automatically categorize a site as a “mobility site.” While valuable, these towers are typically intended to provide continuous coverage for travelers along the highway rather than serving the smaller communities nearby.

When evaluating the value of such a site, factors to consider include the daily vehicle traffic, the significance of connecting smaller towns to major cities, and the strategic importance of those smaller towns—whether as vacation destinations, large residential developments, or areas of political influence—all aligned with the carrier’s broader marketing and network expansion strategies.

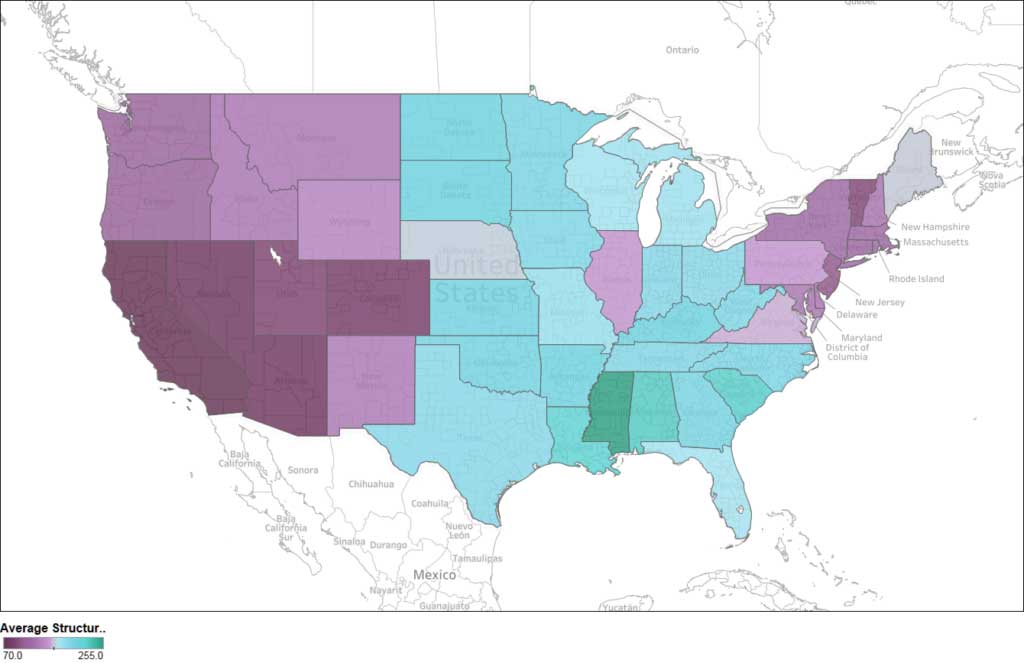

Average Structure Height by States

Proximity to Nearby Cell Sites

At CellWaves, the first step in evaluating a property is a detailed engineering review to assess its value and competitiveness relative to surrounding cell sites. Through this analysis, we determine how critical a site is to a carrier’s network and whether rising rental costs could prompt the carrier to consider terminating the lease.

Leveraging our extensive national database—which includes information on all cell towers, their heights, azimuths, and more—along with satellite imagery, GIS systems, and site morphology, CellWaves evaluates a property’s significance within a carrier’s RF engineering design. Understanding how well a site integrates into the broader macro network is key to accurately determining its lease value.

If your property is geographically central relative to neighboring towers and offers superior ground elevation, there is little justification for a carrier or tower company (such as Crown Castle, American Tower, or SBA) to push for rent reductions. A comprehensive independent assessment—including zoning, leasing, construction, and engineering analysis—ensures an accurate valuation of your site’s current market rental potential.

Unfortunately, inexperienced negotiators often rely on outdated lease rates from decades past, failing to recognize the true value of the site today. At CellWaves, we advocate basing lease rates on current market conditions and the site’s strategic importance—not on outdated agreements from 25 years ago.

Landlord Sophistication

Site acquisition specialists exercise greater caution when dealing with sophisticated property owners, knowing that offers or statements lacking proper support are likely to be swiftly rejected. Consequently, every offer is carefully prepared, backed by data and facts to withstand scrutiny.

Sophisticated landlords—including attorneys, large commercial property owners, corporations, and government agencies—are presumed to be highly knowledgeable unless proven otherwise. These landlords typically retain representation, either through real estate attorneys (who often lack technical expertise in RF engineering) or industry professionals with technical and leasing experience, such as CellWaves personnel.

When experienced representatives are involved, lease negotiations tend to be more realistic and robust from the outset. Carriers have learned to anticipate and plan for longer negotiation timelines in these situations. Ultimately, landlords represented by technical experts and skilled negotiators almost always secure better rental rates and stronger non-financial lease terms compared to unrepresented property owners.

Time Remaining on Existing Leases

Wireless carriers and tower companies maintain internal systems that trigger renewal alerts approximately five years before a lease’s expiration. When alerted, the real estate department initiates the renewal process.

Carriers typically outsource this work to third-party vendors, often incentivizing them with bonuses tied to securing lease extensions without rent increases—or even achieving rent reductions—for long-term extensions, sometimes up to 30 years or more. In contrast, tower companies usually manage this process internally through teams of Leasing Specialists and “Closers” who oversee final documentation.